Need some direction with your benefits? We are here to help.

We understand that enrolling in your benefits can come with some questions. Below are FAQs that can help you trust your decisions and assist with any questions about utilizing your benefits once the new year begins!

The Plan is a type of retirement plan known as a “Profit Sharing 401(k)” Plan. Here are the types of contributions that may be made to the Plan:

All employees of Gordon Food Service and the Specialty Companies that are full-time or part-time over the age of 21 are immediately eligible to participate in the Plan. After you receive your first paycheck, you may begin contributing and receiving the Company Match.

To enroll, visit vanguard.com/register or call (800) 523-1188. To enroll online, you will need your Plan number: 092054. You will need to designate a beneficiary for your account.

Newly hired employees who do not want to save must call Vanguard Participant Services at (800) 523-1188 within 60 days of their first paycheck (or eligibility date, if later) to opt out. Newly hired employees who do not opt out will be automatically enrolled at a 401(k) Payroll Deferral rate of 4%.

Your contribution to your 401k / Roth 401k may not be more than 75% of your “regular” compensation on a weekly basis. In addition, federal law limits the amount of your Pay Deferral Contributions in a calendar year. The dollar limit applies to both types of Pay Deferral Contributions (pre-tax 401k and after-tax Roth 401k) on a combined basis. The dollar limit for 2026 is $24,500. If you are at least age 50 by the end of the calendar year, you may “catch-up” contributions by an additional $8,000. If you are between the ages of 60-63 by the end of the calendar year your “super catch-up” amount is $11,250. These amounts are typically adjusted annually by the IRS.

The company will contribute $1 for each $1 you contribute during a pay period, up to a maximum of 4% of your compensation for that pay period. Although Company Match contributions will be made whether your contributions are pre-tax pay 401k or Roth 401(k) contributions, the Company Match contribution will always be made on a pre-tax basis and will only become taxable when it is distributed to you.

To recognize the effort of each employee and the contribution each has made to the company’s success, the company may decide to contribute a portion of their profitability to employees. At the end of each plan year, GFS will decide on the amount of its Profit Sharing Contribution for that year.

While Profit Sharing is discretionary, the company has contributed a Profit Sharing Contribution each year since the beginning of the Profit Sharing Plan in 1960. Over the past 15 years, the average Company Profit Sharing contribution has been over 8% of an individual’s compensation.

All employees of Gordon Food Service and the Specialty Companies that are full-time or part-time over the age of 21 will become eligible after 90 days of employment.

Your share is based upon your eligible compensation during the plan year (Oct 1 to Sept 30). You and the other employees (whether full-time or part-time) of the company will receive the same percentage of compensation as a Profit Sharing contribution. For example, if your eligible compensation is $50,000 and the company Profit Sharing contribution is 8%, you will receive $4,000 deposited into your 401k account for that year.

No, contract employees are not eligible for the Profit Sharing Contribution.

The Profit Sharing plan year is October 1 through September 30. The eligible compensation made during the plan year time frame is used to calculate your Profit Sharing amount.

Your Profit Sharing contribution will be deposited into your 401k account on December 31st.

Vanguard is the recordkeeper of your 401k/Roth 401k account.

You can log on online at Vanguard.com for 24-hour access to your account as well as investment and financial planning information, guidance, and advice. GFS Plan number: 092054

You can contact Vanguard by phone at (800) 523-1188. Get 24-hour access to your account and investment option information through the automated VOICE® Network. Or speak with a Vanguard Participant Services associate for help with transactions and answers to your questions Monday through Friday from 8:30 a.m. to 9 p.m., Eastern time.

You can download Vanguard’s app to access your account on a mobile device.

The Gordon Food Service Finance Services department administers the GFS plan and can be contacted at 1-616-717-4700 or via email at financeservices@gfs.com.

You can search for providers who are considered in network at https://www.deltadental.com/us/en/member/find-a-dentist.html

As it takes time to update websites, it is suggested that you call the office of any dentist you are considering and ask if they accept Delta Dental of Michigan coverage.

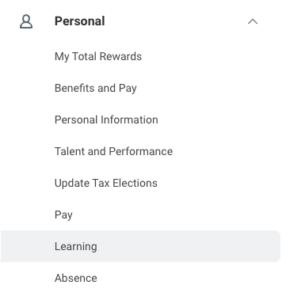

Benefit documents are accessible through the Benefits page on Gordon Grove.

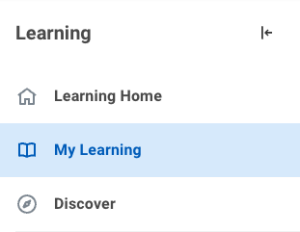

This job aid covers frequently asked questions about Learning and Organizational Development resources.

We have purchased a library of training classes (elearning, virtual and live classroom) from our outside vendor partner, Development Dimensions International (DDI). This means blended learning opportunities will be offered in each competency area.

With supervisor approval, all training opportunities are offered to all employees, regardless of their roles.

The courses below have been identified as critical for skill development based on your role. Employees will find courses available on Workday Learning. People Leaders & Leaders of Leaders will be assigned to courses in Workday automatically then will need to register for a date/time in the assigned courses.

To check on course completion, consult your Learning Homepage in Workday.

No topic is off limits!

This course is only meant for new leaders (individual contributors making the transition to leading people). The L&OD team maintains this course assignment in Workday.

Web-based and virtual training will not incur a cost. However, in-person training may incur travel and materials expenses.

As always, employees must talk with their leaders prior to signing up for classes to create awareness and to ensure they are able to take the time away from work. This should be a part of ongoing development discussions. In addition, leaders would need to approve any travel expenses that may be involved (if any).

Search Our Site…